Digital platforms have become increasingly popular in signage, with display screens in locations such as shopping centres and roadside, becoming a popular way to advertise

The global printed point-of-sale (POS) and signage market amounted to 12.8bn square metres of material in 2014 and was worth over $49.4bn (£37.7bn). Overall POS and signage demand is forecast to grow by 0.8 percent annually to 2020 with indoor signage growing year-on-year by 1.2 percent at the expense of outdoor, which will decline by 0.4 percent year-on-year.

Analysis in the Smithers Pira report The Future of Signage in an Electronic World to 2020 identifies five core factors influencing signage industry trends across the rest of the decade: the nature of point-of-purchase (POP) suppliers, compliance, the effect of print management, globalisation, and the evolution of signage in the wider context of advertising.

Leading up to 2020, demand is expected to decline for billboards, banners, and vehicle graphics

General indicators that influence the demand for printed signage include macroeconomic shifts, such as economic growth (GDP and disposable income) and population growth.

Printed signage is used in many applications, spanning the whole economy; therefore fluctuations in GDP can provide a rational macroeconomic backdrop to potential trends in signage demand.

Specific industries though, such as retail, hospitality, fast food, and out-of-home advertising can provide a much more accurate gauge of likely activity in this particular sector of the wider print and graphic arts market.

Markets for printed signage

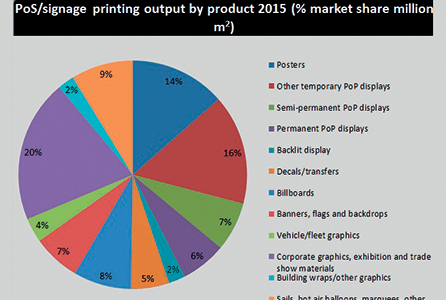

A variety of finished products fall into the category of signage including:

- Posters

- Backlit displays

- Temporary POP displays—such as pop-up displays

and shelf talkers

-

Semi-permanent POP displays—such as pallet displays and corrugated floor units

-

Permanent PoP displays—such as durable permanent floor or counter displays

-

Banners, flags, and backdrops

-

Vehicle and fleet graphics

-

Corporate graphics, exhibition, and trade show materials

The indoor signage market is more than double the size of the outdoor market and it is predicted to grow at the expense of outdoor in the future. Of the total POS and signage output in 2014, 72 percent was used in indoor signage applications and 28 percent in outdoor. Demand is forecast to grow on average by 1.2 percent in indoor output to 2020 while outdoor will show annual declines of 0.4 percent. Offset is the dominant printing process in terms of volume output for indoor applications, while screen is the dominant process for outdoor applications.

Offset is the dominant printing process in terms of volume output for indoor applications, while screen is the dominant process for outdoor applications”

Forecasts to 2020 show that inkjet will be the dominant print process in the future for both applications.

During the period to 2020, demand is expected to decline for billboards, banners, flags and backdrops, vehicle/fleet graphics, and building wraps/other graphics. Billboards are expected to experience the greatest declines at almost 1.5 percent per annum. All other products are expected to see growth in printing output. The products with the highest growth are semi-permanent POP displays decals/transfers and corporate graphics, and exhibition and trade show materials.

Retail trends

The retail industry requires high volumes of printed signage, many of which have a short life span. Therefore retail trends have a significant impact on printed signage demand. Key retail drivers when it comes to expenditure on in-store displays and signage include new store openings, price promotion activity, seasonal promotions, store closures, and the threat from e-commerce.

Vehicle wrapping seems to have shot up in growth over the last few years though this may decline come 2020. Pictured: Grafityp added new films to its GrafiWrap range last year

Over 90 percent of retail spending is through physical stores although technology is playing a greater supporting role. Global retail sales totalled over $22 trillion (£16.8tn) in 2014, of which only 6 percent was through e-commerce sales. China and the US are the world’s leading e-commerce markets.

Retail research states that in Europe in 2015, online retailers are expanding around 14 times faster than conventional outlets and creating strategic issues for store-based retailers. This makes online the fastest growing retail market in Europe with retail spending expected to grow by around 18 percent in 2016. In 2014, Nielsen states that online buying was highest in Asia-Pacific, with online browsing the highest in Latin America.

In 2015, corporate graphics, exhibition, and trade show materials showed the most growth whereas backlit displays and building wraps/other graphics showed the least

Recently there has been a rise in online grocery shopping due to convenience and faster paced lifestyles. It is likely that groceries will be bought online more frequently in the future, impacting store visits.

Compliance is still a major issue affecting temporary and semi-permanent PoP materials. The advent of RFID chips, attached to displays, enables manufacturers to track the exact location of displays and determine whether they have been erected, or when they are taken down.

Leveraging this technology, P and G found that some retailers erected displays correctly only 45 percent of the time. Reasons behind this include poor design and quality, high space use compared to the sales generated, lack of eye-appeal or a clash with existing store décor, and a perception that the signage held little overall benefit to retailers and simply moved sales from one product to another within a category, and did not increase total sales.

Rise of digital signage

Digital platforms, like display screens, are becoming one of the most powerful sources of display and advertising. It has been predicted that worldwide, revenue for digital signage equipment, software, services, and media is growing at around five percent per annum and will hit $17bn (£13bn) by 2017.

The popularity of digital signage is showed further through Clear Channel’s four new sites in London for its premium digital brand, Storm

Many sectors are turning to the use of digital signage in order to enhance the experience of interaction with their customers or clients. There are two function types for digital signage:

-

Advertising-based—used in retail, quick-service restaurants (QSR), and other catering

- Information-based—used in transportation, banking, educational, corporate, and healthcare environments

Retail, restaurants (QSR/convenience), and corporate hold the top three positions within the market worldwide. However, sectors including healthcare and hospitality are showing high growth, especially in North America, which has experienced growth in the digitally based advertising market. The retail sector holds the biggest share in the digital signage market at around 25 percent.

O Factoid: It has been predicted that worldwide, revenue for digital signage equipment, software, services, and media will hit $17bn (around £13bn) by 2017. O

The global market potential of this dynamic technology sector are analysed and quantified in full in The Future of Signage in an Electronic World to 2020 (www.smitherspira.com/industry-market-reports/printing/end-use-markets/future-of-signage-in-electronic-world-to-2020).

Digital platforms are becoming one of the most powerful sources of display and advertising, proven by outdoor screen firm Amscreen which plans to launch larger format digital signage

We are offering SignLink’s readership an exclusive discount of ten percent across all print reports for 2016. Please visit www.smitherspira.com quoting discount code PM10OFF.

Your text here...