Cleaning up

‘Diversification’ is a word that is thrown around a lot in our industry.

Whether it is a manufacturer championing the benefits of how a new

machine can help open up new markets, or a successful company explaining

how it achieved record revenue, it seems that it is ‘diversification or

bust’ for many firms throughout the industry.

One of the main areas that has been mentioned a lot in recent times

among the good and great of the print industry is the opportunities

around the labels market, with many companies having already branched

out into the sector. After all, there is always likely to be a call for

this type of printing, given the widespread use of labels across various

industries.

With this in mind, what other opportunities can this busy sector offer

to companies thinking about diversifying their business? Major

diversified print technology developers such as EFI and Epson have

certainly seen a niche to be developed, as they are able to cross-sell

both their wide-format and digital label printing equipment to the same

commercial print customers.

In EFI’s case it has come to market with its Jetrion 4900, which has ML

and M-330 variants, as well as the 4950LX. Each offers different levels

of productivity, quality output specification, and industrial scale. And

as the company states, each has been developed with diversification

very much in mind: “Now, you can pick up more jobs by doing short-run

printing, labels, packaging, and direct mail jobs. The systems and inks

also allow you to expand into premium margin applications, such as

one-to-one marketing, ‘track and trace’, anti-counterfeiting and brand

protection.

“The versatile Jetrion family even lets you to tap into lucrative

services, such as shrink sleeves, localization, regionalisation and

personalised marketing. The systems lower your bottom line by

eliminating plates, reducing labour and waste costs, alleviating

inventory pressure and shortening turn-around times.”

Similarly, Epson has made a foray into the label market, and made a very

bold pledge to be number one in the sector over the next decade. Its

cornerstone technology is the SurePress L-6034 and L4033AW presses.

With a very strong presence in the wide-format print market, Epson has

now set its cap at the label printing market as a diversification avenue

for its customer. Pictured: The L4033AW carries green and orange inks

for added graphics ‘pop’

“Epson’s strategy is quite simple–but very ambitious,” says Phil

McMullin, sales manager ProGraphics, Epson UK. He adds: “We want to

provide the market with the best combination of printer and ink

technology to deliver high quality, superb reliability and the best all

round return on investment for the broadest range of professional print

applications.”

So with these two juggernauts both throwing their considerable research

and development weight behind the sector, with a core customer base of

commercial and graphics print-service-providers, then it is certainly

worth finding out why.

Busy market

Another key international player heavily involved in this sector is

Fujifilm, which has a host of solutions on offer. James Whitehead,

product manager of Fujifilm Graphic Systems UK, says the market is

currently busy across all sectors—but there is great interest in how to

address short-run production.

He explains: “It’s certainly an interesting market with many sub

segments. Opportunities for niche labelling are probably of most

interest as margins tend to be stronger here. Although as ever with

niches, finding potential customers is harder to do.

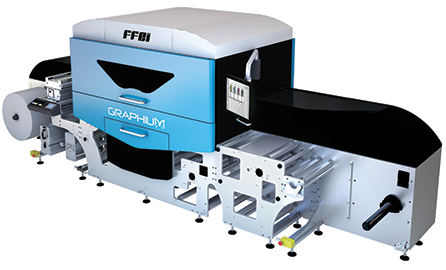

“At Fujifilm, we have seen customers who buy products from else-where in

the Fujifilm portfolio being interested in the FFEI Graphium digital

inkjet press to serve the requirements of their existing customers. It

is a simple-to-use entry point into the label market.”

Manufactured by FFEI, Fujifilm’s Graphium digital inkjet press is

regarded as an entry-level device for those in the label printing sector

Drawing on this, Whitehead goes on to explain more about the Graphium

digital inkjet press. Manufactured by FFEI, he says the digital device

is ‘simple’ to use compared with the skills required to learn and equip

for a flexo production capability.

Whitehead continues: “The Graphium produces labels which have the same

physical properties as those printed with UV flexo inks. Furthermore, it

is a modular press and is capable of being extended to support inline

UV flexo, perhaps for a post print varnish, as well as inline finishing

which is common in the conventional label market. Features such as

lamination, cold foiling or die-cutting can also be integrated to

Graphium to produce a complete inline label press.

“The fully integrated Graphium press, based on Edale’s new FL3 press is

state-of-the-art and simple to use, and allows production of short-run

digital labels to the same standard as an established label convertor.

What’s more, inline finishing facilitates production planning, reduces

waste and minimises total job time compared to off line digital

alternatives.”

EFI’s Jetrion series of label printer has been designed to allow

printers to tap into lucrative services, such as shrink sleeves,

localisation, regionalisation and personalised marketing

Although having championed the labels sector, Whitehead does issue a

warning to companies thinking about moving into the market and advises

that they think carefully about their own capabilities.

“The nature of label production is perhaps different to the type of

print that your business carries out at present,” Whitehead advises,

adding: “Label production is about more that simple flat print and often

requires conversion processes, not only embellishments to the print but

conversion from web to saleable product.”

Label production is about more that simple flat print and often

requires conversion processes, not only embellishments to the print but

conversion from web to saleable product”

Let’s get digital

Elsewhere, inkjet and laser print specialist Domino Printing Sciences is

also championing the labels market. Philip Easton, director of the

firm’s digital printing solutions division, has picked out a number of

sectors in particular that are currently popular in the labels market.

Easton comments: “Digital printing is definitely the fastest growing

technology in the labelling market, and now represents approximately 25

percent of new label presses sold. The flexible packaging and folded

carton markets are also growing in prominence, although these markets

are more concentrated and have higher investment requirements and

barriers to entry.

“Any commercial printer already making some commercial print sales into

the labels and packaging sector would be at an advantage, as it is then

about selling different products to your existing customers, rather than

penetrating new markets with new products.

“Although printing skills are transferable, for printers looking to

diversify into the labels market, there are a still a lot of new skills

to develop. Labels are increasingly being printed with digital

technology and run lengths get forever shorter. For digital printing,

the skill is more in the pre-press area and colour management with very

little on-press interaction. For this reason, printers with colour

management expertise may be better placed to enter this market.”

With this in mind, Easton picks out a number of products Domino has on

offer to support label printers. He claims the Domino N610i is the only

digital colour ink jet label press that combines the productivity of

flexo with the flexibility offered by rapid job change digital

technology. The device offers 600 x 600dpi native print resolution and

operating speeds of up to 75m per minute.

In addition, the K600i offers a monochrome option with high resolution

of 600dpi. Easton says the device is well suited to digital variable

data printing across the full web/sheet width such as codes, barcodes

and 2D codes. Both devices also feature Domino’s i-Tech intelligent

technology, which Easton says offers features designed to optimise print

performance and maintain high levels of productivity.

Investment is key

Another industry heavyweight that is also committed to the labels sector

is Xeikon. Filip Weymans, director segment marketing and business

development labels and packaging, says the sector is much busier than

its sister markets of commercial or document printing.

Filip Weymans, director segment marketing and business

development labels and packaging at Xeikon, says the labels sector is

much busier than the commercial or document printing market

Weymans comments: “The product that label printers and converters make

are items used in manufacturing processes, so the value of the output is

over and above that of a regular communication vehicle.”

O Factoid: During

Coca-Cola’s incredibly successful ‘Share a Coke’ special label

campaign, over 1,000 different names were printed on the labels of

bottles that were sold in shops across the UK. O

However, when quizzed about potential diversification into the sector,

Weymans issues a warning to companies considering such a move: “Unless

you are planning to invest in people and equipment, it is not a good

move. You also have to have a great appreciation of technical sales.

However, if you are looking to diversify your business, spread the risk

over a different market, and make the all round investment needed, then

it could be a good decision.”

“This market is certainly not just about printing,” emphasises Weymans,

adding: “These printed products are pieces of art, but art that must

perform in both packaging and filling lines. Therefore a certain

knowledge level is required which can either be acquired through

acquisition or by education of staff. Several organisations provide good

education info, such as Finat and BPIF Labels.”

In addition to this sound advice, Weymans goes on to highlight a number

of Xeikon products that could help a potential move into the labels

sector: “The Xeikon 3000 Series is a complete family of equipment that

includes entry level products, such as the Xeikon 3030, and top of

class, very productive presses such as the 3300 or the 3500 models.

These should be combined with a DCoat series product for converting the

printed material into self-adhesive labels.”

Xeikon says its 3000 Series features a number of entry-level products, such as the Xeikon 3030 and 3300 models

Saturated market

While manufacturers are unsurprisingly upbeat about the sector, what

about the companies on the frontline of label printing? One firm that

has taken full advantage of the kit on offer from Xeikon is label

manufacturer Peter-Lynn. Victoria Waine, sales and marketing manager at

the company, says although the firm will achieve further growth this

year, the labels market as a whole has become saturated.

Waine enthuses: “This year will see another significant increase in

turnover for PeterLynn and a lot of that will be digital work.

(Above and below) Examples of some of the labels produced by Xeikon customer PeterLynn

“The labelling market in general however has become quite saturated and

this has caused pressure on margins which will not be sustainable for

some businesses. If you were to come to the market now as a potential

competitor, it would require a huge investment in new equipment and a

very steep learning curve in terms of getting up to speed with how to

operate it.

“The labels market has made huge advancements and is very technology-led

now. It isn’t like it was 25 years ago where anybody could put a label

press in their garage and manufacture blanks labels.”

With investment in mind, Waine goes on to explain how PeterLynn recently

upgraded from a Xeikon 3030 to a 3300 label press in order to help the

firm cope with increased demand.

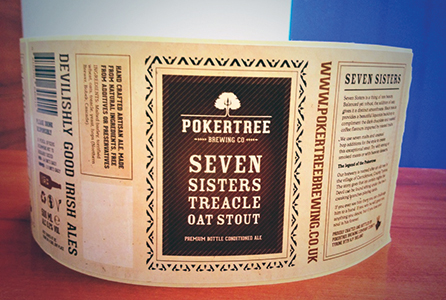

Waine explains: “The Xeikon 3030 proved to be hugely popular within our

existing customer base and with new customers in emerging markets like

the micro-brewery industry. We quickly reached full capacity and needed

to take the next step to help us sustain our growth. The natural

progression was to take the speed upgrade, which allowed us to continue

our expansion plans.

“The main four points that any company should consider when thinking

about making an investment like we did would be; do we have a loyal and

competent team who can be trained to use an advanced piece of technology

like the Xeikon press? Do we have work that can be easily migrated to

digital? Do we have a strong enough financial footing to get through

those first few months when the machine is not paying itself back? Do

the costings and figures stack up in terms of price point and margin?

Can we be competitive with the rest of the market place?”

Specialist sectors

Elsewhere in this arena, family-owned label printing business Hibiscus

is another firm to have taken advantage of the different work available.

According to director James Killerby, the company is enjoying the

benefits of working in a niche sector of the market.

Killerby explains: “We work in a very specialist area of the label

printing market, which needs knowledge and expertise. We don’t just

print labels; we advise companies on what they need to have on their

labels to comply with the law. Although it is a very busy market at the

moment and companies might see an opportunity, they need to be able to

provide the advice to be able to succeed, as well as specially designed

and tested products.

“It is a busy time for us in the chemical label printing market at

present as there are major legislation changes coming in to force next

year. The deadline for the new CLP Regulations on the classification,

labelling and packaging of mixtures is June 1st, 2015, which will be

used globally.

“It is a positive change for the industry and will encourage and

facilitate the international trade in chemicals, as well as ensuring the

protection of human health and the environment across the globe.”

Hibiscus first entered the labels market in 1982 under the leadership of

Killerby’s mother, father and grand-father—all of whom had links with

either print or chemicals. Now, having established itself as one of the

major players in the market, the company is reaping the benefits. With

this in mind, Killerby has some words of wisdom for those companies

considering diversification into this sector.

“Understand the market that you are proposing to print labels for,”

Killerby says, adding: “Each market requires a different style of label,

containing different information. By knowing the market, you will be

able to provide companies with expert advice, which will keep you ahead

of the game and customers returning to you for all their labelling

needs.

By knowing the market, you will be able to provide companies with

expert advice, which will keep you ahead of the game and customers

returning to you for all their labelling needs”

“We provide labels for lots of interesting jobs, many of which you

wouldn’t even think of. From cosmetics companies to car manufacturers,

and just the general haulage of chemicals and dangerous goods, no day at

Hibiscus is ever the same when it comes to our clients labelling

requirements.”

So, the message from those in the labels market seems to be that while

there is plenty of work available, any move into the sector should be

properly considered and carefully planned out. After all, you want your

business to have a positive label of its own.

Your text here...